If you haven’t been paying attention to the market lately, stock indices have been on the move. We’re talking 2% up, followed by 2% down days. This chart from CNBC does a pretty good job of visualizing the markets recent moves.

(Disclaimer: Past performance is not necessarily indicative of future results)

(Disclaimer: Past performance is not necessarily indicative of future results)

Source: CNBC

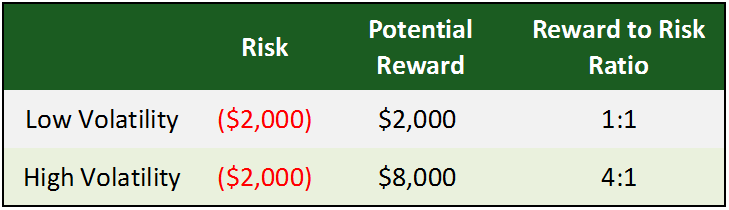

While these type of wild swings make most traditional investors who just buy and hold the stock market pretty nervous, most stock index trading systems are hooting and hollering when they see moves like this. Why? Well, because it brings in the possibility of asymmetrical returns. Whoa, what? That sounds complex. It does, but it’s actually quite simple and centers on the fact that most trading systems have a fixed risk amount (whether the market is barely moving or screaming up and down). So it’s the standard two sided story of risk and reward, except the risk stays constant while the potential reward shoots much higher. Here’s a simple graphic of that concept:

You can see the risk/reward is clearly better when there’s high volatility. Now, of course, this doesn’t mean a system can’t lose more than it’s risk amount. Stops don’t guarantee the desired price, and there is sure to be more whipsaw action in a higher volatility market environment. But all in all, you can’t deny that it opens up more opportunity for these asymmetric risk/reward scenarios. And while there will be losing trades right along side winning ones during high volatility, the asymmetric nature means the winners can be much bigger than the losers.

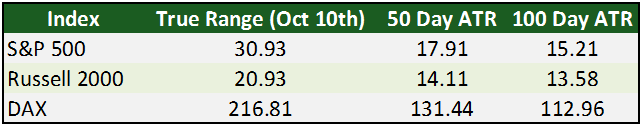

How much as the potential reward gone up? You can use the market’s average true range as a benchmark (it’s hard to make more money than the market can move in a day). Here’s the True Range, 50 day ATR, and 100 Day ATR of the S&P 500, Russell 2000, and the DAX, to show you just how things are expanding.

(Disclaimer: Past performance is not necessarily indicative of future results)

(Disclaimer: Past performance is not necessarily indicative of future results)

Is this recent volatility the start of another big down move like we saw in 2008 – who knows? But it’s nice to be able to swap some volatility loving trading systems into the portfolio in case this sticks around for a bit.