In case you haven’t heard, Stocks aren’t the only things looking like they might go to zero…. Some “Large hedge funds,” according to Bloomberg are predicting Crude Oil to do just that… go to zero. While those type of predictions as great for clickbait, we think they’re being a bit dramatic. Either way, with crude oil having dropped nearly $30 in a few months and putting in some crazy daily moves of $2 to $3 – Crude is looking like a great trading market right now.

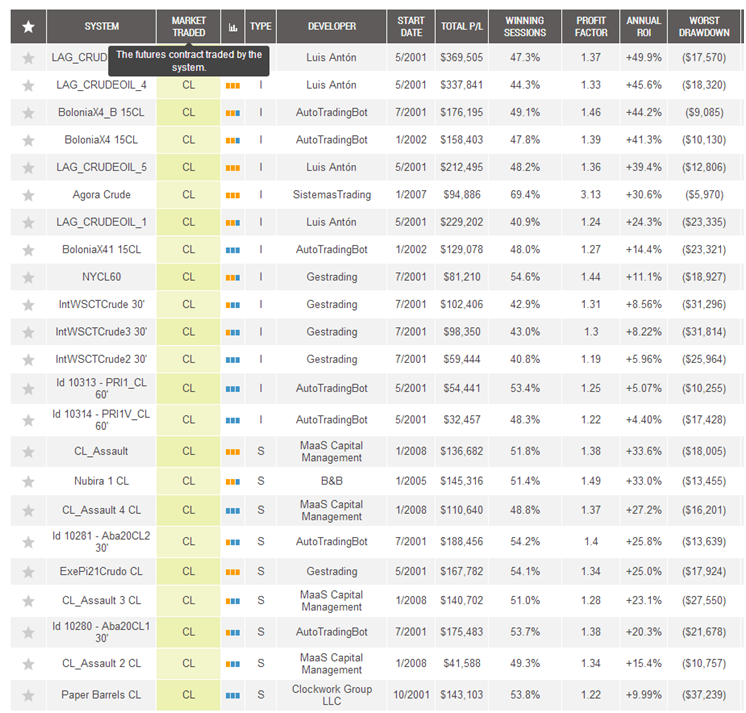

Given all the recent market movement coming from equities, it’s easy to forget that there are trading systems out there that track markets that have nothing to do with stocks. In particular, there are 25 automated trading systems operating on good old, Black Gold / Texas Tea. We’re talking about Crude Oil of course.

First, let’s look at crude’s recent market movement.

(Past performance is not necessarily indicative of future results)

(Past performance is not necessarily indicative of future results)

Chart Courtesy: StockCharts.com

As you can see, it’s not just that crude oil is moving, and not just that it’s moving lower (has come down all the way below the 50 & 200 day Moving Averages). The important thing from a trading system standpoint is that it is moving more lately. You can see those bars getting longer since about the middle of September – and that’s good news for automated models, which typically risk a fixed amount, but can make as much as the market moves. More movement = more possibility for profit.

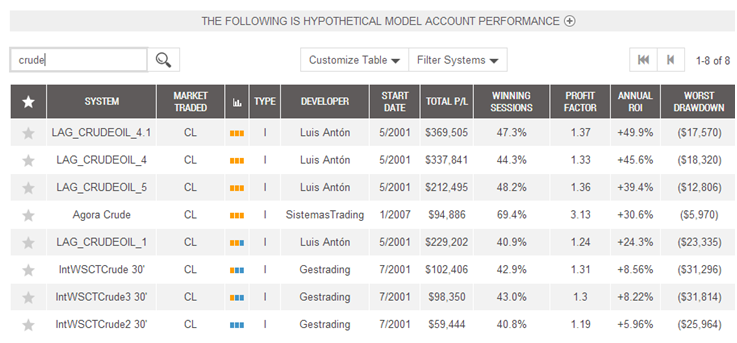

So how do you check out the Crude Oil systems on the iSystems platform. Two simple ways:

- Simply type in Crude Oil in the search box at the top of the page

- Use the built in ‘filter’ tool to show only Crude Oil systems

So go ahead and check out the Oil trading models while this volatility lasts.